unemployment tax break refund how much will i get

Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. These refunds are expected to begin in May and continue into the summer.

Irs Announces More Than 1 5 Billion Of Unclaimed Tax Refunds For 2016 Tax Year The Irs Announced That More Than 1 5 Billi Tax Attorney Paid Leave Tax Refund

However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break.

. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020This tax break was applicable for. Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the American Rescue Plan. In the latest batch of refunds announced in November however the average was 1189.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. Can I track my unemployment tax refund. How to calculate how much will be returned The IRS is in the process of sending out tax refunds for unemployment benefits recipients who mistakenly paid tax.

Tax season started Jan. The Internal Revenue Service IRS announced it will start to automatically correct tax returns for those who filed for unemployment in 2020 and qualify for the 10200 tax break. 24 and runs through April 18.

The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020. Unemployment refunds are scheduled to be processed in two separate waves. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

That too saved jobless workers a fair amount of money. Another thing the American Rescue Plan did was exempt up to 10200 of unemployment benefits from taxes for the 2020 tax year. Generally unemployment compensation is taxable.

Kiss tax breaks for unemployment benefits goodbye This means households that didnt withhold federal tax from benefit payments or withheld too little may owe a tax bill or get less of a refund. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal.

But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic. This is not the amount of the refund taxpayers will receive. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

The first wave will recalculate taxes owed by taxpayers who are eligible to exclude up to 10200. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Specifically the rule allows you to exclude the first 10200 of benefits up to 10200 for each spouse if filing jointly from your income on your federal return if you have an adjusted gross income of less than 150000 for all filing statuses in 2020.

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. And this tax season you. Getting out of paying taxes on 10200 of income can be a good thing.

This summer the IRS started making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who qualify for a 10200 unemployment tax break. Refund for unemployment tax break. Under the new law taxpayers who earned less than 150000 in modified adjusted gross.

The IRS has sent 87 million unemployment compensation refunds so far. The second wave will recalculate taxes owed by taxpayers who are married and filing jointly as well as individuals with more complicated returns. That legislation allowed up to 10200 for single filers of unemployment benefits to be considered tax-free on your 2020 tax return.

If I paid taxes on unemployment benefits will I get a refund. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Unemployment tax breakIRS tax refunds to start in May for 10200 unemployment tax break.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. Unlike stimulus checks which you dont have to pay taxes on unemployment payments are considered taxable income and will need to be accounted for on your 2021 return. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Heres what you need to know. The tax agency recently issued about 430000 more refunds averaging about 1189 each. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a.

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Average Tax Refund Up 11 In 2021

Tax Refund Timeline Here S When To Expect Yours

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refund Timeline Here S When To Expect Yours

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Calculate Your Tax Refund With Aangifte24

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

14 4 Billion Worth Of Tax Refunds Finally Given To Eligible Taxpayers Irs To Distribute 1 600 Refunds Each Before The Year Ends The Republic Monitor

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

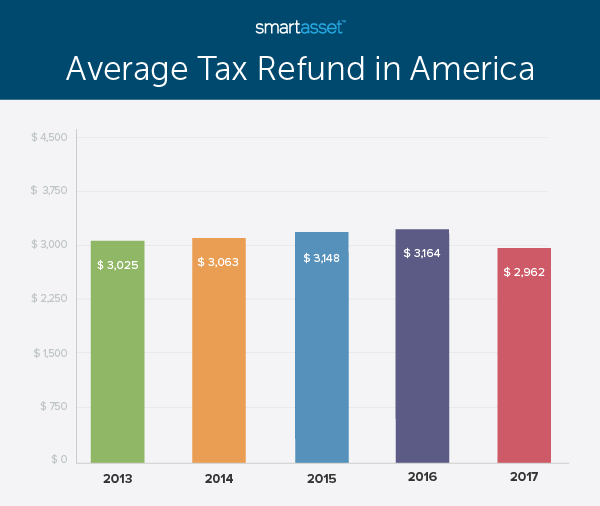

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset

The Irs Can Seize Your Unemployment Tax Refund For These Reasons

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

6 502 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

How To Get The Most From Your Tax Refund Tax Refund Tax Help Tax Services